Clean Energy Is on a Roll: a US$1.7 Trillion BankRoll

By Sunny Lewis for Maximpact

PARIS, France, June 25, 2023 (Maximpact.com Sustainability News) – US$ 2.8 trillion is set to be invested globally in energy in 2023 – a record amount. And US$ 1.7 trillion of that, more than half the total, is expected to go into clean energy technologies, with solar power set to eclipse oil production for the first time, finds the latest World Energy Investment report from the International Energy Agency (IEA).

The rest of the investments, totaling slightly more than US$ 1 trillion, are going into coal, gas and oil.

People are getting excited about investing in renewables, electric vehicles, low-emissions fuels, efficiency improvements and heat pumps, nuclear power, grids, and energy storage.

“The World Energy Investment 2023 report is a barometer on the world’s progress achieving clean energy transitions, given that financial commitments and spending are the ultimate tests of whether policies and pledges translate into action,” comments Simon Bennett, energy technology analyst with the International Energy Agency (IEA).

“The report shows that investment in clean energy technologies is significantly outpacing spending on fossil fuels, as affordability and security concerns triggered by the global energy crisis strengthen the momentum behind more sustainable options.” Bennett says.

Global investment in energy transition technologies, including energy efficiency, reached a record high of US$ 1.3 trillion in 2022. Still, “annual investments need to at least quadruple to remain on track to achieve the 1.5°Celsius scenario” set forth in the Paris Agreement on climate, warns the International Renewable Energy Agency, IRENA.

Engaging the Private Sector

To accomplish the transition to clean energy in time to avert a climate catastrophe will require what the International Energy Agency (IEA) and International Finance Corporation (IFC) call “a massive scaling up of investment” in emerging and developing economies in a special report released June 22.

“Getting on track for net zero emissions by 2050 will require clean energy spending in emerging and developing economies to more than triple by 2030 – far beyond the capacity of public financing alone and therefore demanding an unprecedented mobilization of private capital,” the two agencies say.

This special IEA-IFC report examines how to scale up private finance for clean energy transitions by quantifying the investments required in different regions and sectors to build modern, clean energy systems, including achieving universal access.

The new global energy economy represents a huge opportunity for growth and employment in emerging and developing economies. This report’s analysis identifies key barriers and how to remove them, and sets out the policy actions and financial instruments that can deliver a major acceleration in private capital flows for the energy transition.

Bennett, the IEA analyst, says policy support for innovation in many countries is growing as governments cope with the energy crisis and seek more resilient and diversified clean energy supply chains. “The United States Inflation Reduction Act, for example, provides a huge boost to the drivers of clean energy innovation,” he said.

“Early-stage equity funding for energy start-ups had its biggest year ever in 2022, with increases in most clean energy technology areas. Funding for start-ups in CO2 capture, energy efficiency, nuclear and renewables nearly doubled or more than doubled from 2021, which was already much higher than the average of the preceding decade. This type of funding supports technology testing and design and plays a critical role in honing good ideas and adapting them to market opportunities,” Bennett explains.

Multilateral Banks Collaborate

Also this week, leaders of the Inter-American Development Bank and the International Monetary Fund (IMF) committed to stronger collaboration to address climate change and boost green finance in Latin America and the Caribbean.

President of the IDB Ilan Goldfajn, and Kristalina Georgieva, managing director of the IMF, met to discuss an enhanced collaboration to support climate reforms and catalyze private sector resources in Latin America and the Caribbean.

Working groups are being set up to work on the design and implementation of climate finance solutions both at regional and country levels.

In parallel, the IDB is designing a facility to identify, prioritize and prepare a pipeline of green and resilient infrastructure projects across all key sectors. It will also help governments in Latin America and Caribbean in their upstream regulatory and institutional work.

For instance, on June 22 Serra Verde, a Denham Capital portfolio company, announced a US$150 million investment by Vision Blue Resources and the Energy & Minerals Group in its integrated rare earth element mining and processing operation in Brazil. Together, Denham, EMG and VBR’s participation will accelerate and expand production of the rare earth elements, specifically those used in permanent magnets critical to the transition towards a low carbon economy.

Serra Verde, located in the established mining jurisdiction of Minacu, in Brazil’s Goias State, is the largest known ionic-clay rare earth element deposit outside of Asia. Samples of the concentrate from this large, long-life deposit have already been tested and accepted by major customers, with whom the company has established off-take agreements.

Serra Verde will produce a unique mineral concentrate containing a high value combination of both heavy and light magnetic rare earth elements, including neodymium (Nd), praseodymium (Pr), terbium (Tb) and dysprosium (Dy). All four of these rare earth elements are essential to the manufacture of permanent magnets for use in electric vehicle motors and wind turbine generators

Africa is Ripe for Investment

In Africa lie mineral deposits, including those critical in the manufacturing of green technologies. The Democratic Republic of Congo produces 70 percent of the world’s cobalt, Zambia is the second largest producer of copper on the continent, and South Africa holds the greatest share of manganese reserves.

Cobalt is hot property today, used in rechargeable batteries in smartphones and laptops. It’s a component of lithium ion batteries that power electric vehicles and store energy from solar, wind and other renewable sources, giving it an essential role in the transition from fossil fuels to green energy.

A highly efficient conduit, copper is used in renewable energy systems to generate power from solar, hydro, thermal and wind energy. Copper helps reduce CO2 emissions and lowers the amount energy needed to produce electricity.

Besides a green energy transition, the world is also experiencing a massive technological one. Demand for critical metals and raw minerals is set to soar as the world gears up for the race to net zero, placing the mining sector at the core of the green energy transition.

As the world’s youngest continent, African countries can leverage the value chain of manufacturing through domestic industrialisation, creating new job opportunities for a growing workforce. The energy transition is estimated to create over nine million jobs by 2030, which would outweigh the job losses that will take place in fossil fuel industries.

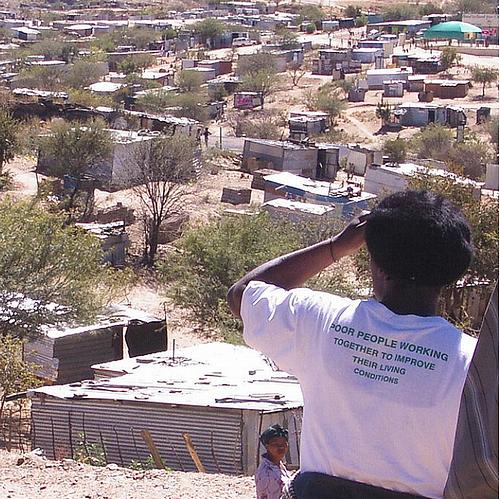

For instance, the African Development Bank’s Urban and Municipal Development Fund has approved a grant of $485,000 for a solar electricity project in Namibia that will power some 50,000 households in the capital city.

The program will directly benefit around 200,000 people in Windhoek, where around 20 percent of the population does not have electricity.

In Windhoek, one consequence of rapid and uncontrolled urbanization is the rise in informal settlements, characterized by non-electrified neighborhoods and underdeveloped economic activity.

The Municipal Council of Windhoek requested the Fund’s support to upgrade services in its informal neighborhoods. Installing electricity in informal settlements is considered a crucial investment to unlock the economic potential of these areas and raise the living conditions of the inhabitants.

The project is expected to take off this year with the installation of 60 megawatt solar photovoltaic systems and related batteries, the development of an overall structural plan for the rehabilitation of the informal settlements with a participatory process to identify and prioritize investment opportunities unlocked by electrification.

The impact is expected to be enormous, the Bank said. The availability of electricity services will not only support the development of household activities, but also small and medium size companies, as seen in neighboring already electrified communities, resulting in job creation and substantial improvements in services such as water, mobility, green areas, and market opportunities.

The solar energy will help eliminate greenhouse gas emissions from burning firewood and kerosene, reducing deforestation, and improving air quality.

Socio-economic benefits such as expanding universal access to energy, and improvements to public health with reduced air pollution, are improvements IRENA’s Welfare Index has identified.

The IMF and IDB will enhance strategies for countries to accelerate climate financing, through policy reforms, capacity-development support, and evaluating tailored financing arrangements – such as blended finance instruments, green bonds and others, including potential designs for a regional green fund structure.

This report, “Scaling Up Private Finance for Clean Energy in Emerging and Developing Economies,” <https://www.iea.org/reports/scaling-up-private-finance-for-clean-energy-in-emerging-and-developing-economies> is part of the IEA’s support of the first global stocktake of the Paris Agreement, which will be finalized in the run-up to COP28, the next UN Climate Change Conference, scheduled for Nov 30 through Dec 12, at Expo City Dubai in the United Arab Emirates.

Find other reports in this series on the IEA’s Global Energy Transitions Stocktake page. <https://www.iea.org/topics/global-energy-transitions-stocktake>

This year marks the finalisation of the first global stocktake of the Paris Agreement.

Stocktakings measure the world’s collective progress against its climate goals. In support of that effort, the IEA is bringing together all of its latest data and analysis on clean energy transitions in one place, making it freely accessible to citizens, governments, and industry.

“Reaching net zero emissions requires a complete transformation of how we power our daily lives and the global economy,” the IEA advises.

The IEA’s Net Zero by 2050 Scenario lays out a narrow but achievable pathway to net zero emissions in the energy sector by mid-century, a trajectory consistent with limiting global temperature rise to 1.5 degrees Celsius above pre-industrial levels.

Many investors say that this path represents the world’s best hope of avoiding the worst effects of climate change. It requires accelerating the shift to non-emitting sources of energy, such as wind and solar; increasing energy efficiency; electrifying transport, industry and buildings; expanding the use of clean hydrogen and other low-emission fuels, and developing technologies that abate harmful emissions.

And accomplishing all of that takes brave and far-sighted investors willing to bankroll these projects.