Global Investors for Sustainable Development

A New Alliance: Global Investors for Sustainable Development

By Sunny Lewis

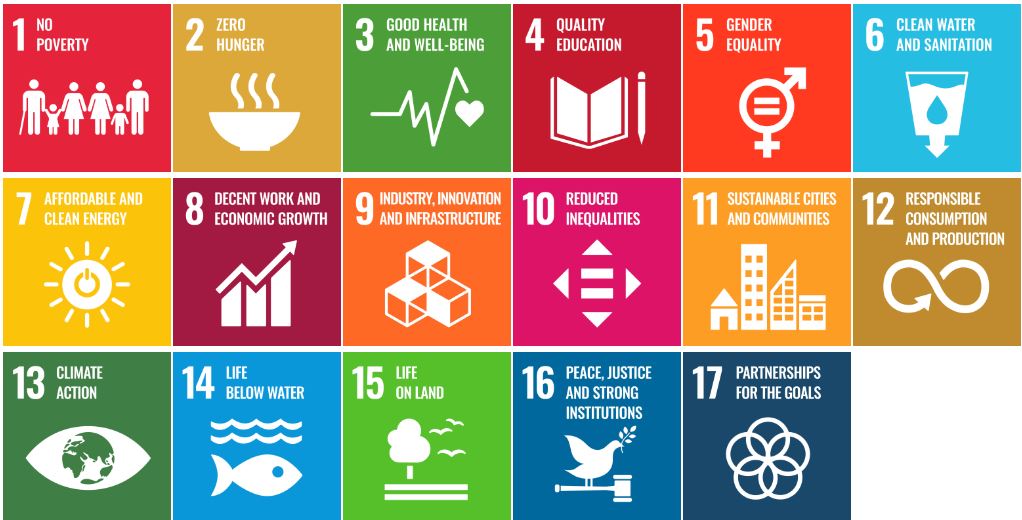

The 17 Sustainable Development Goals were featured on billboards in New York City’s Times Square to promote the #SDGs-related events that happened during the meeting of the United Nations General Assembly, September 19, 2019, United Nations Department of Economic and Social Affairs via Twitter @SustDev

NEW YORK, New York, October 17, 2019 (Maximpact.com News) – Thirty influential corporate leaders have agreed to cooperate over the next two years in an effort to free up trillions of dollars from the private sector to finance the Sustainable Development Goals, the United Nations announced on Wednesday.

Convened by Secretary-General António Guterres, the Global Investors for Sustainable Development (GISD) Alliance is co-chaired by Oliver Bäte, CEO of the German multinational financial services company Allianz, and Leila Fourie, CEO of South Africa’s Johannesburg Stock Exchange.

“As responsible companies, we can create long-term value by embedding sustainability into our core business,” said Bäte. “Investing in the stable development of societies across the globe is not only the right thing to do, it also includes economic opportunities. We are convinced that investments in emerging markets can foster sustainable growth without losing sight of our customers’ interests.”

A broad range of industries is represented in the Alliance, from banks such as Malaysia’s Commerce International Merchant Bankers (CIMB) to the Moroccan mineral water company Eaux Minerales d’Oulmes; from pension groups such as the UK’s Aviva, Japan’s Government Pension Investment Fund, and the California Public Employees’ Retirement System, to industrial companies such as the Italian multinational energy company Enel and Kenya’s mobile network operator Safaricom. [See complete list below.]

“We face widening inequality, increased devastation from conflicts and disasters and a rapidly warming Earth. These leaders have seized our sense of urgency, recognizing that our pace must be at a run, not a crawl,” Guterres said.

“They are committing to cooperate across borders, across financial sectors and even with their competitors, because it is both ethical and good business sense to invest in sustainable development for all people on a healthy planet,” said the UN leader.

The 2030 Agenda for Sustainable Development, adopted by all UN Member States in 2015, provides a blueprint for peace and prosperity for people and the planet, now and into the future. At its heart are the 17 Sustainable Development Goals (SDGs), which recognize that ending poverty and other deprivations must go hand-in-hand with strategies that improve health and education, reduce inequality, and spur economic growth – all while tackling climate change and working to preserve oceans and forests.

Formation of the Alliance comes with growing recognition in the corporate community that the success of companies is closely linked to a sustainable future for the world.

Caption: Elliott Harris (center), UN Chief Economist and Assistant Secretary-General for Economic Development, briefs the press on the launch of the Global Investors for Sustainable Development (GISD) Alliance. He is flanked by Oliver Bäte (left), Chairman of the Board of Management of Allianz SE and Co-Chair of the GISD Alliance, and Leila Fourie, Chief Executive Officer of the Johannesburg Stock Exchange and Co-Chair of the GISD Alliance. October 16, 2019, UN Headquarters New York, (Photo by Loey Felipe courtesy United Nations)

“The Alliance has come together to help drive financing for the 2030 Agenda as we enter a crucial decade of action to deliver the Sustainable Development Goals,” UN Deputy Secretary-General Amina Mohammed said, “and, in particular, to help forge concrete solutions for securing the long-term finance and investment necessary to achieve the SDGs.”

Secretary-General Guterres has established a timeline for actionable results over the life of the Alliance. Its work will be coordinated by the UN’s Department of Economic and Social Affairs.

The High-Level Dialogue on Financing for Development held during the opening of the UN General Assembly in September focused the world’s attention on the urgent need to increase government spending on health, education, infrastructure, and climate change.

Most developed countries have not met their commitments to Official Development Assistance – contributions of donor government agencies to developing countries – while factors like poverty, corruption, and tax evasion limit domestic resources in developing countries.

Trillions of Dollars Are Needed

Sustainable development finance needs are estimated at trillions of dollars per year, and even if funding from all public sources is maximized, there will still be a shortfall, making financing from the private sector essential.

UN research suggests that there is no shortage of money from the private sector which could be invested in sustainable development. Yet a combination of factors, including the policy environment, incentive structures and institutional conditions, tend to discourage the kind of long-term commitment that is needed.

“The establishment of the GISD Alliance acknowledges the scale of the challenges we face collectively and the role that the finance sector has to play in meeting these challenges,” said Fourie of the Johannesburg Stock Exchange.

“Exchanges are a vital part of the financing ecosystem – promoting relevant disclosure, enabling effective price discovery, and ultimately mobilising funds to productive ends,” she said. “We all have much work to do, and the time to start is now.”

The UN’s chief economist Elliott Harris told reporters at news conference held on Wednesday to introduce the Alliance, “The core focus of the Alliance is to propose and develop concrete solutions for mobilizing long-term finance, long-term investment for sustainable development.”

“Its aim is not only to mobilize the money, but to provide advocacy and to provide guidance on how the enabling conditions for this type of long-term investment can be improved,” said Harris, “how financial instruments can be innovated and designed to facilitate the mobilization of this long-term finance, and also to find ways of channeling the resources to the sectors in the countries that need these resources.”

“The members of the alliance collectively control some US$16 trillion of assets. They operate in over 160 countries on six continents of the world, and they serve more than 700 million retail and corporate clients,” Harris said.

“These are very, very important people who lead very, very important enterprises, and they’ve come together following the call of the secretary-general to build this alliance, to mobilize the financing that we need to make sustainable development a reality,” he declared.

Members of the Alliance aim to use their expertise, influence and business acumen to stimulate long term investment in development and speed up progress towards achieving the Sustainable Development Goals.

The 2030 Agenda for Sustainable Development provides a global blueprint for dignity, peace and prosperity for people and the planet, now and in the future.

(Image courtesy United Nations)

Over the next two years, the group will:

* – Deliver solutions to unlock long-term finance and investment in sustainable development at both company and system-wide levels;

* – Mobilize additional resources for countries and sectors most in need;

* – Find ways to increase the positive impact of business activities; and

* – Align business practices with the 2030 Agenda for Sustainable Development.

The GISD Alliance is part of the UN’s strategy on financing for sustainable development, informed by the Addis Ababa Action Agenda. Agreed in 2015, the Action Agenda provides a global framework for financing sustainable development by aligning all financing flows and policies with economic, social and environmental priorities.

It includes a set of policy actions, with measures that draw upon all sources of finance, technology, innovation, trade, debt and data, in order to support achievement of the 17 Sustainable Development Goals.

Upon concluding the Addis Ababa Action Agenda, then UN Secretary-General Ban Ki-moon said, “This agreement is a critical step forward in building a sustainable future for all. It provides a global framework for financing sustainable development.” He added, “The results here in Addis Ababa give us the foundation of a revitalized global partnership for sustainable development that will leave no one behind.”

Global Investors for Sustainable Development Alliance Membership:

* – Allianz SE, Germany, represented by Oliver Bäte, CEO

* – APG, Netherlands, Ronald Wuijster, CEO

* – Aviva, United Kingdom, Maurice Tulloch, CEO

* – Banco Santander, Spain, Ana Botin, Group Executive Chairman

* – Bancolombia, Colombia, Juan Carlos Mora Uribe, CEO

* – Bank of America, USA, Brian Moynihan, Chairman & CEO

* – Caisse de dépôt et placement du Québec, Canada, Michael Sabia, President & CEO

* – California Public Employees’ Retirement System, USA, Marcie Frost, CEO

* – CIMB, Malaysia, Zafrul Aziz, Group CEO & ED

* – Citigroup, USA, Michael Corbat, CEO

* – Consejo Mexicano de Negocios, Mexico, Antonio Del Valle Perochena, President

* – Eaux Minerales d’Oulmes, Morocco, Miriem Bensalah Chaqroun, CEO

* – Emirates Environmental Group, UAE, Habiba Al Mar’ashi, Co-Founder & Chairperson

* – Enel S.p.A, Italy, Francesco Starace, CEO & GM

* – First State Super, Australia, Deanne Stewart, CEO

* – Government Pension Investment Fund, Japan, Hiro Mizuno, Exec. MD & Chief Investment Officer

* – ICBC, China, Shu Gu, President & ED

* – Infosys, India, Salil Parekh, CEO & MD

* – Investec Group, South Africa, Fani Titi, Co-CEO

* – Johannesburg Stock Exchange, South Africa, Leila Fourie, CEO

* – Nuveen, USA, Vijay Advani, CEO

* – Pal Pensions, Nigeria, representative to be named at a future date

* – PIMCO, USA, Emmanuel Roman, CEO

* – Safaricom, Kenya, Michael Joseph, CEO a.i.

* – Sintesa Group Indonesia, Shinta Widjaja Kamdani, CEO

* – Standard Chartered, United Kingdom, José Viñals, Group Chairman

* – SulAmerica, Brazil, Patrick Antonio Claude de Larragoiti Lucas, Chairman

* – Swedish Investors for Sustainable Development, Sweden, Richard Gröttheim, CEO, AP7

* – TDC Group A/S, Denmark, Allison Kirkby, Pres. & Group CEO

* – UBS Group AG, Switzerland, Sergio P. Ermotti, Group CEO