A checklist for prospective donors looking for outstanding investing opportunities in social good.

+Read More

A checklist for prospective donors looking for outstanding investing opportunities in social good.

+Read More

The largest public pension fund in the United States, the California Public Employees’ Retirement System (CalPERS) has joined the UN Environment Programme (UNEP) in calling for a new culture of sustainable investing.

+Read More

Human impacts are no longer minor in relation to the overall scale of the ocean. A coherent overall approach is needed, according to the first World Ocean Assessment, issued earlier this month.

+Read More

Investing in forestry means investing not only in trees but in people and in sustainable development, delegates to the 14th World Forestry Congress in Durban affirmed last week.

+Read More

The backbone of Asia’s economies is SMEs, but these companies need better access to finance to grow and generate new jobs for the region

+Read More

The multi-billion dollar Green Climate Fund, committed to mobilize $100 billion a year by 2020 to help developing countries cope with climate change, is now ready to fund its first projects.

+Read More

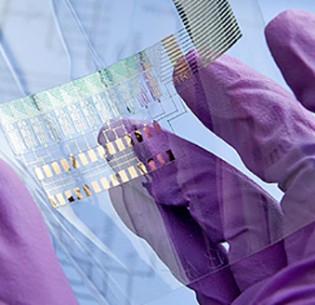

Wearable electronics, smart bandages and self-monitoring weapons systems are among the innovations expected from a new $171 million manufacturing center for flexible hybrid electronics.

+Read More

Plastic debris washing into the oceans from rivers, sewers and landfills is killing off the world’s seabirds, finds an international team of scientists, who advocate better waste management practices.

+Read More

More than 1,200 hospitals and health centers in 13 countries are pledging to take meaningful action on climate change in a worldwide campaign.

+Read More

University of Exeter Scientists have taken the V-shaped wing of a common butterfly and created a more efficient solar cell.

+Read MoreWhether you’re an executive director, board member, funder, staff member or even a volunteer in a nonprofit, chances are you feel frustrated with the inefficiency of your organization’s decision-making processes.

+Read More

There’s been an important shift in the story we’re telling ourselves about social, responsible and impact (SRI) investing. A movement that began with an emphasis on social entrepreneurs and social businesses has become preoccupied with investors and the mechanisms of the marketplace. What caused this shift to happen? And is it necessarily a bad thing?

+Read More

A new generation of women investors are wealthy, confident and keen on investments with a social dimension. To meet their needs, an ecosystem of female financial advisors, female social entrepreneurs and female-led venture capital firms and investing networks is growing fast.

+Read More

At its most effective, communication is a two-way process. Developments in engagement practices between companies and social, responsible and impact (SRI) investors are showing us that this idea is now more applicable than ever.

+Read More