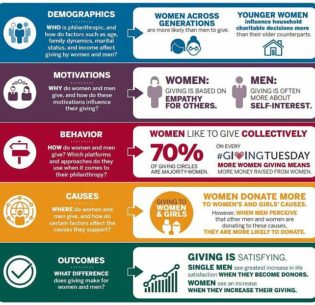

When planning campaigns, wise fundraisers take into account the real differences in the ways in which women and men give to charitable organizations. “From motivations to causes to behavior, women and men demonstrate different giving patterns,” finds new research from the Women’s Philanthropy Institute at the Indiana University Lilly Family School of Philanthropy.

+Read More